Chapter 13 Discharge Papers Things To Know Before You Get This

101(10A). To figure out whether an anticipation of misuse develops, all private debtors with mainly consumer debts who submit a chapter 7 instance must complete Official Insolvency Form B22A, qualified "Statement of Current Regular Monthly Earnings and also Suggests Examination Estimation - For Usage in Phase 7." (The Official Types might be acquired at lawful stationery stores or downloaded from the web at They are not available from the court.) An involuntary chapter 7 situation might be commenced under certain scenarios by a petition submitted by creditors holding cases against the borrower.

trustee program is carried out by the Department of Justice. For purposes of this magazine, recommendations to united state trustees are also appropriate to bankruptcy administrators. A cost is charged for transforming, on demand of the debtor, a situation under chapter 7 to a situation under phase 11. The cost billed is the distinction between the declaring charge for a chapter 7 as well as the declaring cost for a phase 11.

There is no cost for transforming from chapter 7 to chapter 13. Unprotected debts usually may be defined as those for which the extension of credit rating was based simply upon an analysis by the financial institution of the borrower's capacity to pay, as opposed to guaranteed financial obligations, for which the extension of credit rating was based upon the financial institution's right to take security on default, in addition to the debtor's ability to pay.

Some Ideas on How To Get Copy Of Bankruptcy Discharge Papers You Need To Know

The deals for financial items you see on our system originated from business that pay us. The money we make helps us provide you access to cost-free credit rating as well as reports and aids us produce our various other great tools as well as academic products - how do you get a copy of your bankruptcy discharge papers. Settlement might factor right into exactly how as well as where products show up on our platform (and also in what order).

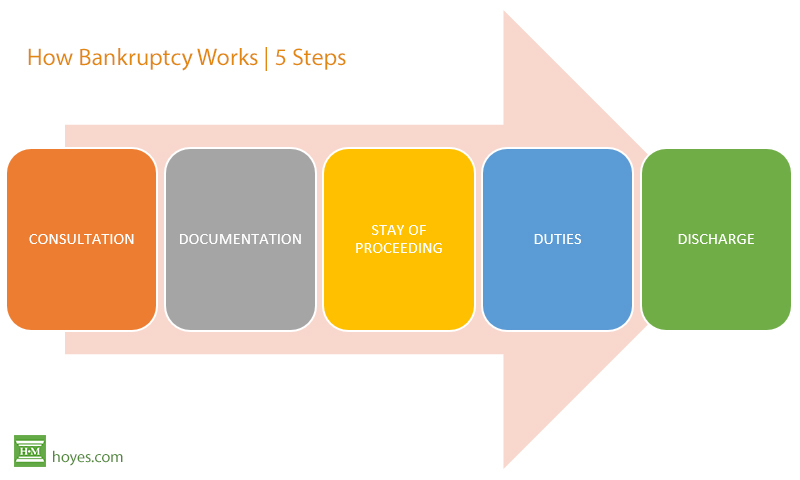

That's why we provide attributes like your Authorization Odds as well as cost savings estimates (how to obtain bankruptcy discharge letter). Obviously, the offers on our platform do not stand for all monetary products around, yet our goal is to reveal you as lots of excellent choices as we can. The very first step in determining whether a personal bankruptcy is right for you is specifying what it is.

Discharge is the legal term definition you're not legally called for to pay the debt, and enthusiasts can not take any type of additional activity to gather it. Adhering to an insolvency discharge, debt enthusiasts and also lending institutions can no more attempt to collect the discharged financial debts. That indicates no much more calls from enthusiasts and say goodbye to letters in the mail, as you are no more directly accountable for the financial debt.

How To Obtain Bankruptcy Discharge Letter Things To Know Before You Get This

With a safeguarded debt, the car loan is tied to a property, or security, that loan providers can take if you quit paying. Unsecured financial obligation is not backed by collateral, so lending institutions don't have the exact same recourse. If you feel the squashing weight of bank card financial obligation and also a vehicle loan on your shoulders, a bankruptcy could be a feasible option presuming you comprehend the consequences.

When you clean your financial slate with a bankruptcy, you'll have to handle some credit-related effects. An insolvency will remain on your credit history records for up to either seven or 10 years from the date you submit, relying on the type of personal bankruptcy. Since your credit score scores are determined based upon the details in your credit report records, a personal bankruptcy will affect your credit ratings as well.

For additional information, take a look at our post on what occurs to your credit when you declare personal bankruptcy. A discharged Phase 7 bankruptcy and also a discharged Phase 13 insolvency have the exact same influence on your credit history, though it's possible a lending institution might look much more favorably on one or the various other - how to get copy of bankruptcy discharge papers.

5 Simple Techniques For How To Get Copy Of Chapter 13 Discharge Papers

Eliminating financial obligation enthusiasts is a terrific benefit, however you might invest the bulk of ten years fixing your debt. A personal bankruptcy discharge might be the best method for you to leave financial debt. Take into consideration various other paths to financial debt flexibility and financial security, such as a debt negotiation or a debt payment plan, before choosing personal bankruptcy as the best means forward.

He has an MBA in financing from the College of Denver. When he's far from the key-board, Eric takes pleasure in exploring the world, flying little Learn more..

Find out more concerning financial obligations released at the end of Chapter 13 insolvency. Noand lots of find this reality shocking. Rather than detailing the wiped-out financial debts, the order will provide general details about financial obligation classifications that don't vanish in bankruptcy or "nondischargeable financial obligation." For circumstances, it will explain that you'll likely continue to be in charge of paying: domestic support obligations (spousal or child assistance) most pupil financings and also tax obligation financial obligation accounts that the court determines you can't release most penalties, charges, and criminal restitution some debts that you failed to provide properly specific fundings owed to a retirement cash owed as a result of injuring a person while running an automobile while intoxicated, and also liabilities covered by a reaffirmation agreement (a court-approved contract to continue paying a financial institution).

Facts About Copy Of Bankruptcy Discharge Revealed

Commitments arising from fraudulence dedicated by the borrower or injury triggered by the borrower while intoxicated are financial obligations that the court may declare nondischargeable. chapter 13 discharge papers. A discharge eliminates you of your responsibility to pay a financial debt, it will not get rid of a lien that a financial institution could have on your home.

Some liens can be gotten rid of, nonetheless, also after the closure of the insolvency instance. After the court releases the discharge, financial institutions holding nondischargeable financial debts can continue collection efforts.

The details permits the financial institution to verify the insolvency and that the released debt is no longer collectible. You'll find the filing date as well as instance number on top of nearly any document you get from the court. The discharge date will certainly show up on the left-hand side of the discharge order promptly alongside the providing judge's name (you'll discover the situation number in the top box). copy of chapter 7 discharge papers.

By using this site you agree to this Privacy Policy. Learn how to clear cookies here

Is Jenson Tauroni the Best Kid Ever? Find Out Why! Un article écrit par une intelligence artificielle sur Chris Wright Store Displays Atlanta Hyperbaric Center A Comprehensive Guide to Getting Top-Quality Cell Phone Repair in Las Vegas with Smart Fix NW คลิปเต็ม! Cr. ข่าวบันเทิง Tiktok All news about medicine. ILBU Brighthouse Cleaners YouTube SPAM Videos Ruining Online Dating Category