Our Life Insurance Online Ideas

3. Full your application, To get an universal life insurance plan, you'll initially have to complete an application. On the application, you'll have to address questions concerning your lifestyle as well as case history. Concerns that you'll likely have to respond to include your: Name, Address, Employer, Annual revenue, Age Height, Weight, Medical conditions, Way of living behaviors and pastimes"They'll wish to recognize your lifestyle," Lewis said.

An insurance policy is an agreement, and by providing false information, you run the danger of voiding the agreement or your insurance firm either canceling your plan, or worse, rejecting to provide a survivor benefit to your beneficiaries. 4 (Term life insurance Louisville). Complete a medical examination, Many life insurance coverage policies need a medical examination to determine whether you're eligible for a plan and identify your costs.

Life Insurance Louisville

Address: Louisville, KY

You'll additionally get an extensive physical that consists of the medical professional measuring your high blood pressure, pulse, height, and weight and collecting a blood and pee sample. Not all insurance coverage need a medical examination, yet remember that those that do not may include greater premiums. 5. Finalize your policy, Once the insurance provider has finished underwriting your policy as well as you're authorized, you're ready.

Getting The Life Insurance Companies Near Me To Work

In many cases, your application might be rejected or held off because of health or lifestyle factors. In this instance, you can make way of life changes such as quitting smoking cigarettes, slimming down, or switching to a less risky profession and after that reapply down the road. You could additionally attempt getting a various plan via a different insurance firm (American Income Life).

While several companies focus on providing life insurance policy, several of the most prominent insurers of auto as well as house coverage likewise supply global life plans. DynamicModern provides a selection of life insurance coverage policies to select from, consisting of universal life insurance policy. Modern does not in fact underwrite its own life insurance policy plans. Rather, when you apply, your information is redirected to e, Financial, which gives quotes from Integrity life and also various other insurance companies not connected with Progressive.

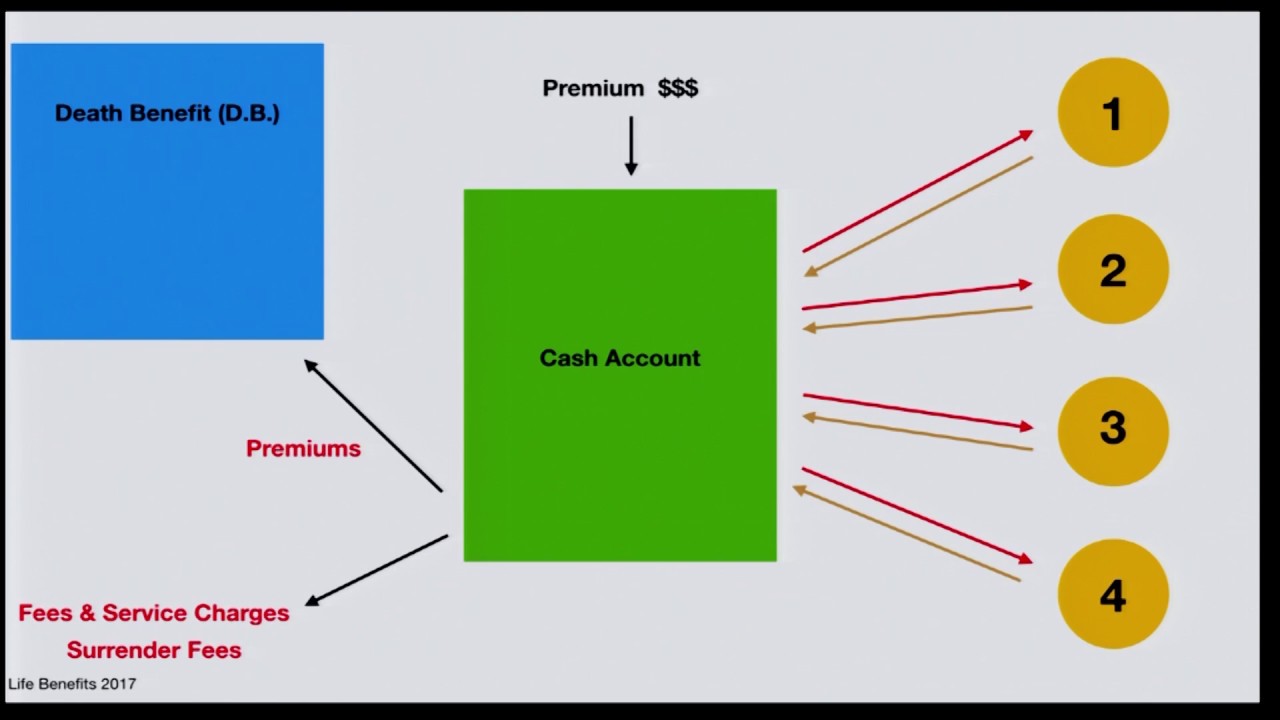

Keep in mind, Progressive does not finance or service your policy. Life insurance quote online. They simply reroute you to another business. Plans may include a tax-free fatality advantage, easy access to your built up cash money worth, and also long-term care security to combine 2 insurance coverage coverages right into one policy.

Not known Facts About Life Insurance Louisville Ky

To get a quote, you'll have to call to talk with a representative. You can acquire protection for people ages 15 days to 80 years, and insurance coverage quantities vary from $50,000 to $250,000 - Kentucky Farm Bureau.

Among the benefits of Farmers life insurance policy plans is that numerous don't call for a medical exam. Nonetheless, you can not obtain an online quote as well as will certainly need to talk with a representative to subscribe - Whole life insurance.

Last Updated 8/25/2021 Life insurance coverage provides economic security for loved ones must the insurance holder die. When a plan is released, an insurer may not cancel it based upon an adjustment in the policyholder's health and wellness condition. There are several sorts of life insurance coverage, allowing customers to discover a policy type that benefits their personal situation.

The Buzz on Life Insurance Louisville Ky

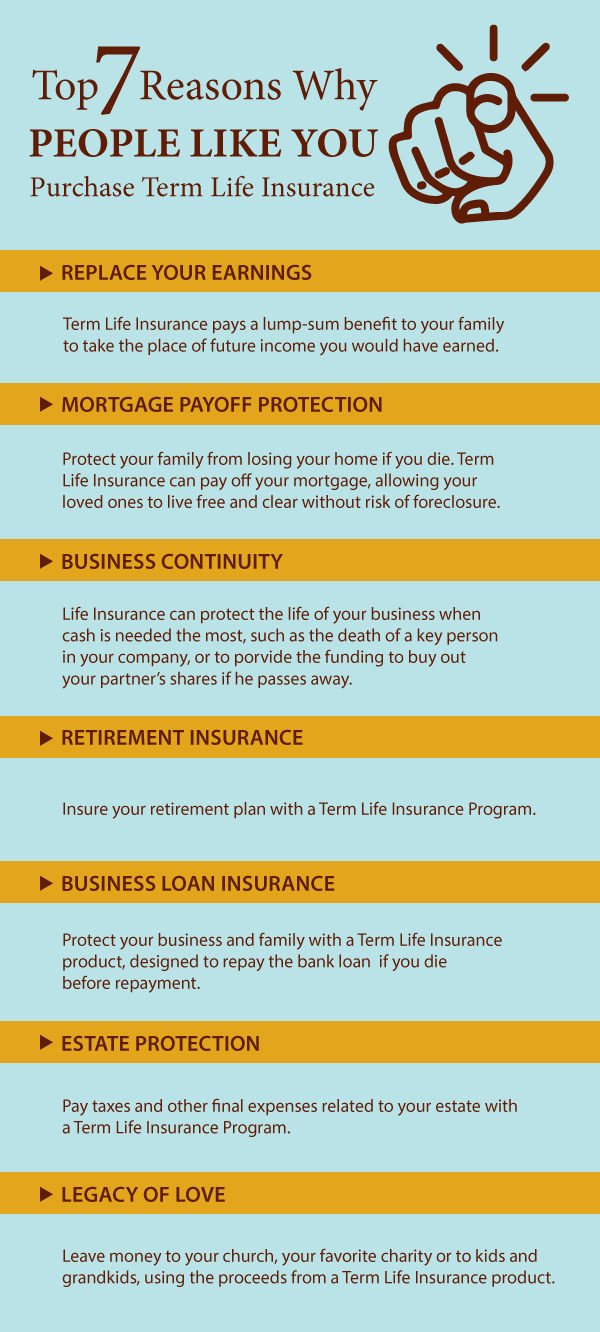

Normally, term insurance coverage policies are composed for 1, 5, 10, or 20 years, or to a defined age (such as 65). Term policies only pay a fatality benefit to the beneficiary if the policyholder dies throughout the defined term and also so is a good choice when the insurance holder needs security for a short-term time or a particular need.

By using this site you agree to this Privacy Policy. Learn how to clear cookies here

Macchiarini - kirurgen som ljög och bedrog Вирус оспы обезьян: все, что нужно знать Mommy's Time Haven: Elevate Your Parenting Journey with Premium Baby Gear and Motherhood Essentials Feyenoord en Heerenveen: een enerverend duel in de stromende regen BIGBANG BIGBANG: The Legendary Boy Band That Made History K Dramas My Lyn 온라인카지노