The Definitive Guide for Lawyer For Life Insurance Claims

The Definitive Guide for Lawyer For Life Insurance Claims

Nevertheless, health plans argue in a different way. They indicate research studies that suggest as much as 30% of medical care is unneeded and that physicians sometimes prescribe the incorrect treatment. appeal denied life insurance claim.Cathryn Donaldson,a spokesperson for America's Health Insurance coverage Plans, states prior authorization isn't indicated to prevent client care. "Similar to doctors utilize scientific proof to identify the most safe, most-effective treatments, medical insurance service providers rely on information and evidence to understand what tools, treatments and innovations finest enhance client health,"Donaldson states." Insurance coverage service providers partner with doctors and nurses to identify alternative techniques that have much better outcomes and enhance results. However medical professionals are assaulting a crucial tool. Donaldson says AHIP and these groups.

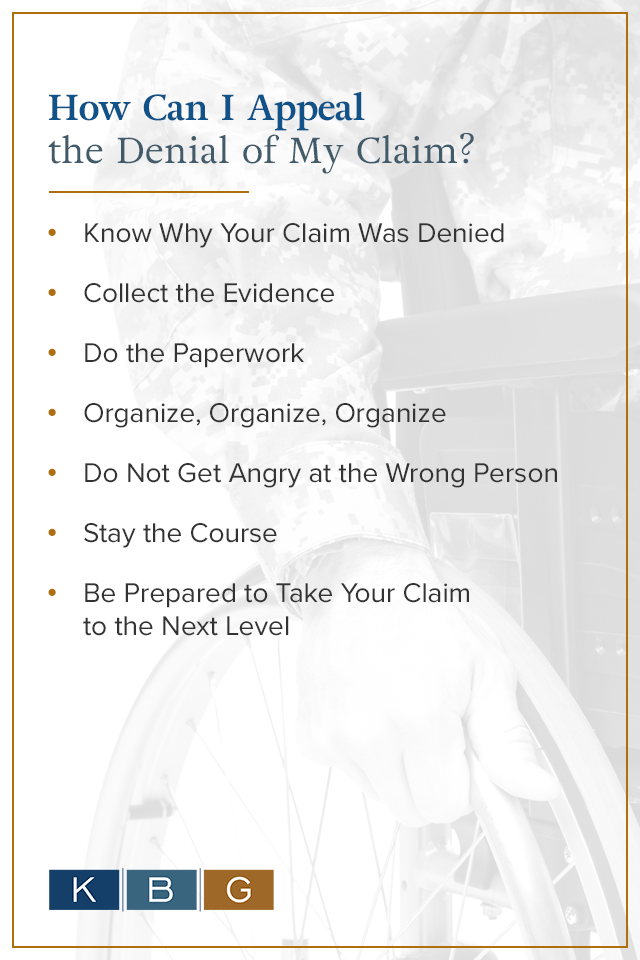

"are devoted to timeliness. In reality, most prior authorizations are approved within 72 hours for urgent care and under two weeks for nonurgent care. "You have several choices if your insurance company rejects prior permission."You can gather more medical proof and appeal-- first informally, and after that following the official treatments described in the notices you get from your insurance coverage plan,"Fish-Parcham states."Before filing the official appeal, take adequate time to comprehend the factors for a denial and gather evidence to refute those factors. However don't hesitate to deal with your medical professional or other provider to informally press the plan to reconsider the choice."If you submit all this proof and your insurer still declines your appeal, you can do numerous things. A better choice may be to go through your state's appeals process. The majority of states permit customers to request an independent evaluation of their claim. During this process, an independent physician will examine the insurer's decision and come to a decision about your claim (life insurance lawyer). Talk to your state's department of insurance to discover out when you can ask for an external review. In Massachusetts, for instance, you can ask for an external evaluation approximately 4 months after you get a letter from your insurer rejecting your appeal. As a customer, it is necessary to comprehend the appeal and review procedure after a claim denial. Studies have shown appeals are typically more successful than not. One Federal government Responsibility Workplace research study found that in between 39-59%of appeals made directly to.

insurance provider led to turnarounds, so if you get a rejection letter from your insurance provider company, it does not hurt to put in the time to contest it.-- Barbara Marquand added to this report - dispute denied life insurance claim. You recently had a medical procedure, however now your insurance will not pay for it. If that's what you are facing, you're likely annoyed and upset. But don't panic. You may have the ability to get your plan to.

reverse its decision. Look over the summary of advantages in your insurance documents. The documentation should spell out what's covered. It likewise has to note the constraints or exclusions, which are things your insurance coverage won't cover. Then read over the letter or form your insurance coverage plan sent you when it rejected your claim. It should tell you why the claim was rejected. The letter should tell you how to appeal your health insurance's decision, and where you can get help starting the process. It's crucial to understand who to ask for assistance. Call your insurer if you do not know why your claim was denied or if you have other questions about it. Be sure to ask if the claim wasrejected because of a billing mistake or missing information.

The Buzz on Lawyer For Life Insurance Claims

If you think you may want to appeal the choice, ask the agent to go over the procedure with you or to send you a description of how to appeal. Keep records. Compose the name of the individual you spoke with, the date, and what was done or decided. Do this for every single telephone call. Ask your doctor's personnel to fix the mistake and send the paperwork to your insurance coverage again. Call your employer's HR department if you have protection from your job - Denied Life Insurance Claim Lawyer. Speak to the health advantages supervisor. They could help (dispute denied life insurance claim).

For instance, ask if your company could send out a letter-- or place a call-- describing why your claim stands. That could convince the insurance coverage business to reverse its choice and pay the claim. If your insurance coverage company refuses to pay the claim, you have a right to file an appeal. The law permits you to have an appeal with your insurance company as well as an external evaluation from an independent 3rd party. Examine your strategy's web site or call customer care. You'll need in-depth guidelines on how to submit an appeal and how to finish particular types. Make sure to ask if there is a due date for submitting an appeal.

If you're filing an appeal, let your physician or the hospital understand. Ask that they hold back on sending you bills up until you hear back from your insurance business - dispute denied life insurance claim. Also, make sure that they won't turn your account over to a debt collectors. Call your physician's workplace if your claim was rejected for treatment you've currently had or treatment that your doctor states you require.

By using this site you agree to this Privacy Policy. Learn how to clear cookies here

Fielding Law Group Antwerpen - Unie Tsitsipas: de Griekse God van het Tennis 188clbco VI68 Family Doctor Brooklyn Italy Serie D Girone D LIVE HD WATCH STREAMING LIVE Italy Serie D, Girone A Italian Serie D Girone H Streaming Links