Get The Best Deal By Comparing The Medigap Benefits Of Each Policy

There are many private insurance providers offering various Medicare policies. You can get many advantages when you watch out for guidelines and then buy one. Before you buy it is imperative for you to know about all medigap benefits so that you choose the right things. There are various aspects that the insurer needs to analyze. You can take up professional help to know what to expect out of the policy which you buy. It is also important for you to talk with the executive and note down the important points which will help you in comparison.

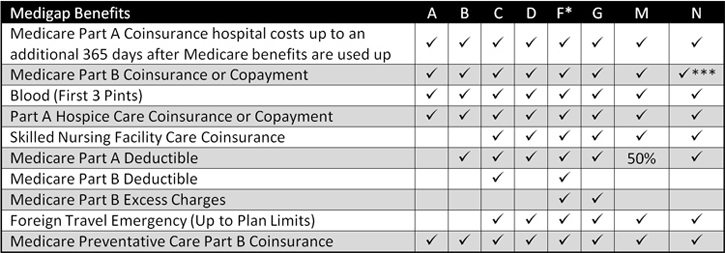

Start with listing the many providers and the Medicare supplement insurance they offer. You will not have to sit in front of the web looking out for the best and the lowest chargeable medigap plan. It is easy to get the medigap benefits chart from those executives you are in talk with. Meet them, share your expectations and get their suggestions for moving ahead with the right policy. You should also look up at the most important points mentioned so that you pick on the best.

- Insurance provider details:

When you are looking out for the affordable medicare insurance, make a proper search of the insurance provider. This is a very important thing as the benefits are mainly dependent on the provider. You will get good benefits just when the company you choose is genuine. You can also go through some other options that they have. The comparison is possible only when you know the companies and their characteristics before making the final decision. You can then pick on the best insurance policy from the right company.

- Check the policy offers for each coverage:

The next step which holds importance is the verification of the mapd medicare policy. Make sure you go through all of the details written in the document. The difference would be in the features and benefits that each policy offers. It is no point in looking at policies which do not fit your budget. You should analyze the policy properly so that you get the best cover. It will take some time definitely as you will have to ask others too. It is only the professional who can provide you good help on the same.

- Premium amount:

You will have to pay the premium amount for the selected policy and avail the medigap benefits. It becomes essential to check the plan and rates in order to get the maximum coverage. You should also get to know about all the payment details so that you know how much you have to invest. These are all little things which will matter a lot. You will then know whether it is all in budget or not. There are some which might cost you a big hole in the pocket mainly because you will not understand the calculations.

So, always have a proper research on the internet and accordingly decide the policy and avail the Medigap benefits.

By using this site you agree to this Privacy Policy. Learn how to clear cookies here

Fumigering: Den ultimate løsningen for å utrydde rotter! Norway 2nd Division, avd 2 มหาชนชิงแชมป์เวิลด์: รวมความสำเร็จและความเปลี่ยนแปลงของวงการมวยปล้ำ ONE Championship Odilio Fruhschulz's Unbelievable Journey to the Edge of the World! Lost in the Maze of History: Odilio Facerias' Unforgettable Journey to the Ruins of Tulum Odilio Noales: The Man Who Saw the Future of Music The 20-point SEO checklist for startups E-Lins Technology An eugeroic medication to promote wakefulness and enhance mental capacity