A Biased View of Capital Gains Taxes California

1031 Exchanges have a very stringent timeline that requires to be followed, and normally require the support of a qualified intermediary (QI). Keep reading for the guidelines as well as timeline, and also gain access to even more information regarding updates after the 2020 tax year below. Take into consideration a story of 2 investors, one that made use of a 1031 exchange to reinvest revenues as a 20% down payment for the next building, as well as another who utilized resources gains to do the same thing: We are making use of round numbers, omitting a great deal of variables, and presuming 20% total appreciation over each 5-year hold period for simplicity.

This table likewise doesn't represent present cash money circulation produced throughout each hold duration, which would probably be higher when using 1031 exchanges to increase acquiring power for each reinvestment. After two decades, the expected profile value of $1,920,000 when going after a 1031 exchange strategy contrasts positively with a forecasted worth of just $1,519,590 when paying funding gains tax obligations along the road.

Below's recommendations on what you canand can't dowith 1031 exchanges. # 3: Evaluation the Five Usual Sorts Of 1031 Exchanges There are five common kinds of 1031 exchanges that are frequently made use of by investor. These are: with one residential or commercial property being soldor relinquishedand a substitute residential or commercial property (or buildings) bought throughout the permitted home window of time.

It's vital to keep in mind that capitalists can not receive profits from the sale of a building while a replacement property is being recognized as well as acquired - 1031 exchange rules.

The Best Guide To 1031 Exchange

Tax Advantage 1031 Exchange

Address: 74710 Hwy. 111 Ste 102 Palm Desert, CA 92260

Phone: 888-470-2785

The intermediary can not be a person that has actually served as the exchanger's representative, such as your worker, attorney, accounting professional, lender, broker, or genuine estate representative. It is finest practice nonetheless to ask among these individuals, usually your broker or escrow officer, for a referral for a qualified intermediary for your 1031.

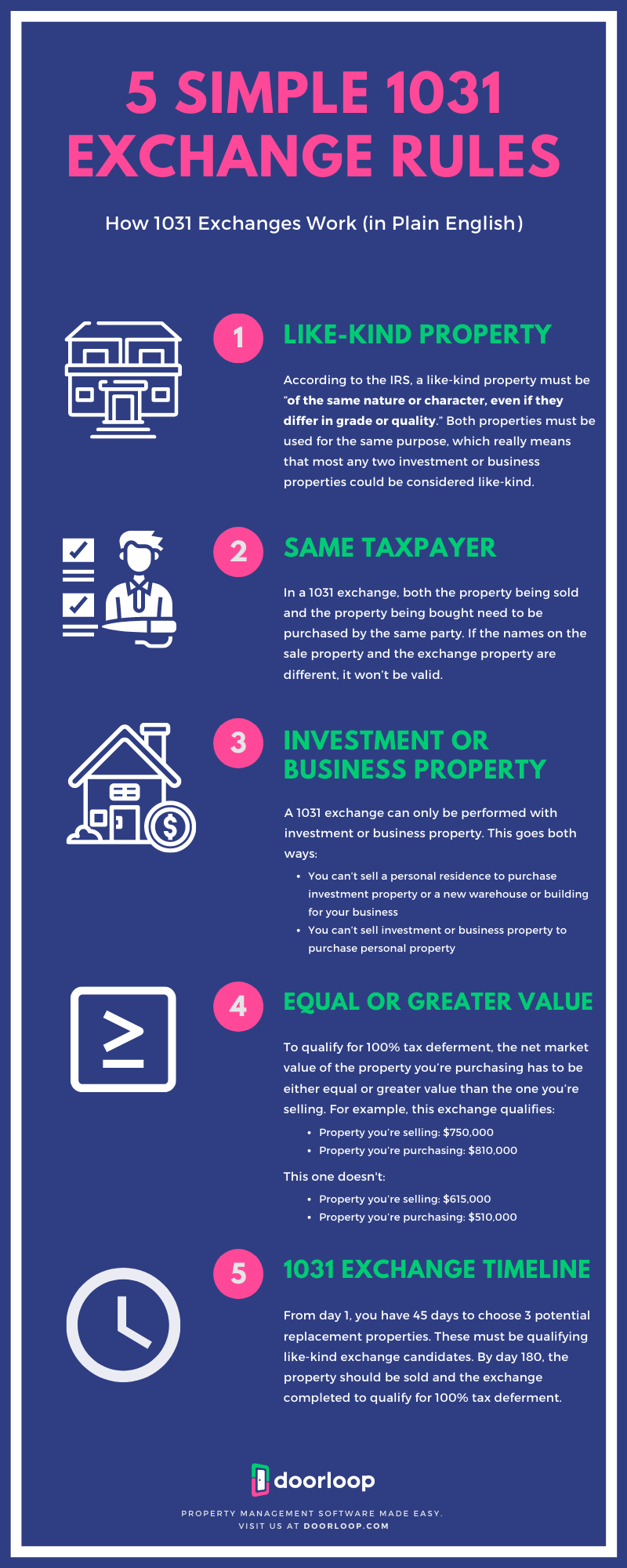

The three main 1031 exchange guidelines to follow are: Substitute property ought to be of equal or higher value to the one being sold Replacement home should be determined within 45 days Replacement residential or commercial property have to be acquired within 180 days Greater or equal worth replacement home policy In order to make the most of a 1031 exchange, investor ought to identify a replacement propertyor propertiesthat are of equivalent or higher value to the property being offered.

That's because the internal revenue service just permits 45 days to identify a substitute home for the one that was sold - what is 1031 exchange california. Yet so as to get the very best cost on a replacement residential or commercial property experienced actual estate capitalists don't wait up until their residential property has been marketed before they begin looking for a replacement.

The probabilities of getting a good rate on the home are slim to none. 180-day window to acquire substitute residential property The acquisition and closing of the substitute home must occur no later on than 180 days from the time the current building was marketed - 1031 exchange real estate. Remember that 180 days is not the exact same point as 6 months.

Not known Details About What Is 1031 Exchange California

1031 exchanges additionally function with mortgaged home Genuine estate with an existing home loan can additionally be used for a 1031 exchange. The amount of the mortgage on the substitute building need to be the very same or better than the mortgage on the residential or commercial property being marketed. If it's much less, the difference in value is dealt with as boot and it's taxable.

To keep points basic, we'll think five points: The present building is a multifamily structure with a price basis of $1 million The marketplace worth of the building is $2 million There's no home loan on the residential property Charges that can be paid with exchange funds such as payments as well as escrow costs have actually been factored into the expense basis The funding gains tax obligation rate of the homeowner is 20% Selling actual estate without using a 1031 exchange In this example let's act that the real estate investor is tired of possessing realty, has no beneficiaries, and chooses not to pursue a 1031 exchange.

8% internet financial investment tax on high income earners + any kind of extra state resources gains tax obligations depending on where the building is located. In The golden state, the state resources gains tax obligation obligation can be as high as an extra 13 (tax shelter real estate). 3%, or an additional $133,000! Offering actual estate utilizing a 1031 exchange Rather, we 'd utilize a 1031 tax-deferred exchange and also adhere to these actions: Offer the existing multifamily building and also send out the $1M proceeds out of escrow straight to a 1031 exchange facilitator.

5 million, as well as a house building for $2. 5 million. Within 180 days, you could do take any kind of among the adhering to actions: Purchase the multifamily building as a replacement home worth at the very least $2 million and also postpone paying capital gains tax obligation of $200,000 Purchase the 2nd apartment for $2.

The Ultimate Guide To What Is A 1031 Exchange

5 million and also pay $100,000 in funding gains tax obligation on the taxed gain (or boot) of $500,000 Purchase the shopping mall with one more home for a total substitute worth of greater than $2 million as well as postpone paying funding gains tax # 6: Job to Remove Funding Gains Tax obligation Completely 1031 exchanges deferor postponed to the futurethe payment of built up resources gains tax obligation.

Which just mosts likely to reveal that the claiming, 'Absolutely nothing is sure except fatality and tax obligations' is only partly real! To Conclude: Things to keep in mind regarding 1031 Exchanges 1031 exchanges enable investor to defer paying capital gains tax obligation when the proceeds from property marketed are utilized to acquire replacement property.

Rather than paying tax obligation on capital gains, genuine estate capitalists can put that money to function immediately and take pleasure in higher present rental earnings while expanding their profile faster than would certainly or else be feasible (what is 1031 exchange california).

By using this site you agree to this Privacy Policy. Learn how to clear cookies here

Choosing a Rottweiler Breeder: What to Look for England Amateur Southern League, Premier Division Central Montpellier – Lorient : un match de haut vol en perspective XIN88 - Nhà Cái Xanh Chín An Toàn Và Hợp Pháp Top 1 thidaihocbrandscom Rikvip Australia NPL, Western Australia Optimum body to body massage sexy Los Altos junk removal near me